Claire*, 42, was always told: “Follow your dreams and the money will follow.” So that’s what she did. At 24, she opened a retail store with a friend in downtown Ottawa, Canada. She’d managed to save enough from a part-time government job during university to start the business without taking out a loan.

For many years, the store did well – they even opened a second location. Claire started to feel financially secure. “A few years ago I was like, wow, I actually might be able to do this until I retire,” she told me. “I’ll never be rich, but I have a really wonderful work-life balance and I’ll have enough.”

But in midlife, she can’t afford to buy a house, and she’s increasingly worried about what retirement would look like, or if it would even be possible. “Was I foolish to think this could work?” she now wonders.

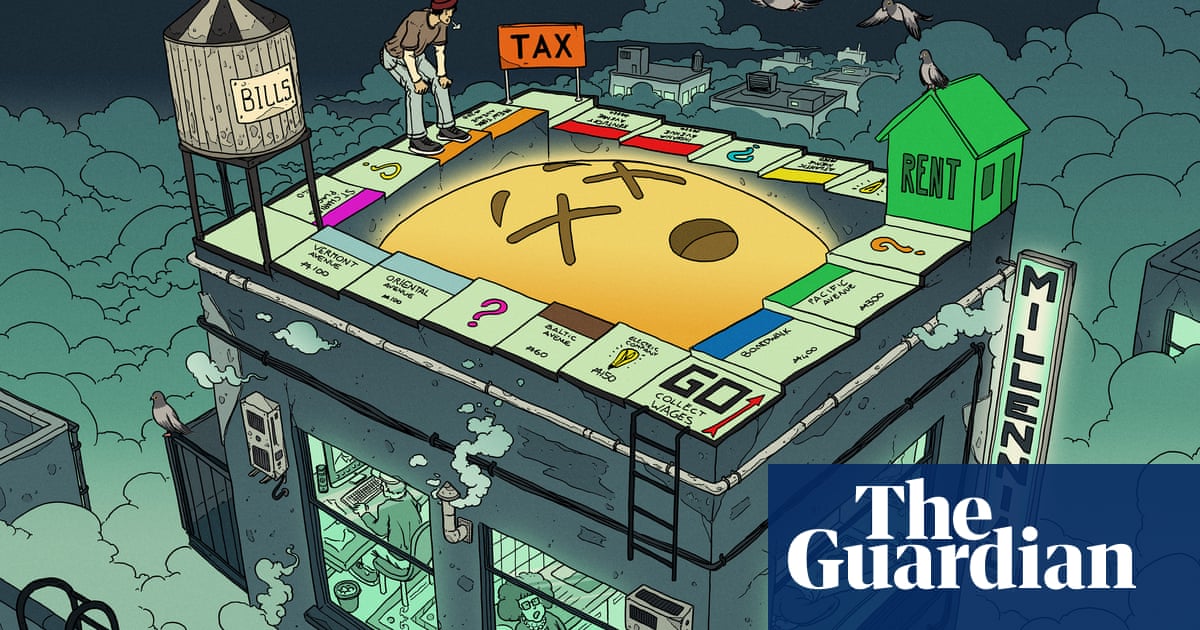

She’s one of many millennials who, in their 40s, are panicking about the realities of midlife: financial precarity, housing insecurity, job instability and difficulty saving for the future. It’s a different kind of midlife crisis – less impulsive sports car purchase and more “will I ever retire?” In fact, a new survey of 1,000 millennials showed that 81% feel they can’t afford to have a midlife crisis. Our generation is the first to be downwardly mobile, at least in the US, and do less well than our parents financially. What will the next 40 years will look like?

Plus, modern MBAs see turnover as a good things because it makes the short-term investors happy.

Wtf why?

Sociopathy, lack of long term planning skills, drugs (metaphorical and physical). Some combination of those I suspect.

For some, you get the Jack Walsh thinking that some employees are going to be statistically bad performers, so it is good to get rid of them.

You also have other cases where lowering the time to train means you can expand faster since you don’t need to find quality staff. The original McDonald’s trained its staff to be able to be high output restaurants. The business model changed to needing less worker training to help fuel expansion.

You also have the case where some managers believe some jobs only require a commodity level labor. At that point, there is no value in training.

So tired of hearing that shitstain’s name. I admit there is some wisdom to the up or out approach. You know for very very high level workers. Like C-suite or a rank below. Doing it across the company just promises misery and failure.

Christ…

Faust…

This is an appropriate reaction, in my opinion. Modern economic philosophy is entirely myopic with no apparent perceived value in anything beyond the next quarter. From that perspective, if your employees have already created value and you’ve budgeted more than severance would cost (or think you can get away with constructive dismissal), then, for the quarter, getting rid of employees looks like a financial positive.